True cross-platform ad relevance is achieved not by creating siloed creative for each channel, but by building a unified data architecture that serves the right user, regardless of the platform.

- Audience fragmentation and cookie deprecation make traditional platform-centric advertising inefficient and obsolete.

- A single customer view, powered by a Customer Data Platform (CDP), is the foundational element for consistent, relevant messaging.

Recommendation: Shift budget and strategy from platform-specific optimization to developing a centralized data infrastructure that enables audience-first activation.

For the modern Media Buyer, the digital landscape feels less like a global village and more like a collection of walled cities. Juggling creative assets, targeting parameters, and audience data across Meta, TikTok, LinkedIn, and Google is a constant battle against fragmentation. The common advice—”adapt your creative for each platform”—is a tactical hamster wheel. It treats the symptom, not the cause. You end up with a patchwork of campaigns that are individually optimized but strategically disconnected, leading to ad fatigue, wasted spend, and a disjointed customer experience.

The real challenge isn’t creative adaptation; it’s data coherence. The platforms are designed to keep their data in-house, forcing you to rebuild audiences and retarget ineffectively within each silo. This leads to fundamental errors, like showing an acquisition ad to a loyal customer or failing to cap ad frequency across a user’s entire digital journey. The platitudes of “right message, right person, right time” fall apart when you can’t see the whole person or their complete timeline.

But what if the solution wasn’t to work harder within each platform, but to build a strategic layer on top of them? This article rejects the platform-first approach. Instead, we will build a tactical framework for establishing a single customer view. This is not about simply creating different ad versions; it’s about architecting a system where your audience data is consolidated, your messaging is intelligently sequenced, and your budget is allocated with a holistic understanding of the customer journey, no matter which platform they happen to be on.

We’ll deconstruct the core challenges you face daily and provide sophisticated, actionable solutions. This guide outlines a new way of operating, moving from reactive, platform-specific adjustments to a proactive, audience-centric strategy that delivers true relevance at scale.

Summary: A Tactical Framework for Cross-Platform Ad Relevance

- Why Cookie Deprecation Forces a Shift to Contextual Targeting in Q4?

- How to Consolidate Audience Data From Fragmented Channels Into a Single Customer View?

- Niche Industry Sites vs Big Tech: Where to Allocate Budget for B2B Precision?

- The Frequency Cap Error That Causes Ad Fatigue on Connected TV Platforms

- How to Adapt Creative Assets for 3 Distinct User Mindsets During the Day?

- Exclusion Logic: The Missing Step That Saves 20% of Ad Spend for Agencies

- Why LinkedIn Is Becoming Pay-to-Play for Company Pages in 2024?

- How to Layer Interest and Behavioral Data for 3x Higher Ad Relevance?

Why Cookie Deprecation Forces a Shift to Contextual Targeting in Q4?

The end of third-party cookies isn’t just a technical hurdle; it’s a fundamental shift in the advertising paradigm. For media buyers, relying on behavioral tracking across the web is becoming untenable. This forces a strategic pivot not back, but forward—to a more sophisticated form of contextual targeting. While traditional contextual was about basic keyword matching on a page, modern contextual uses AI-driven semantic analysis to understand the nuanced meaning and sentiment of content. This allows for precise ad placement that aligns with the user’s immediate frame of mind, without invading their privacy.

This shift is not a compromise; it’s an upgrade in relevance and consumer trust. While behavioral ads follow users with their past actions, contextual ads meet them in their present moment of interest. This alignment feels more natural and less intrusive to the user. In fact, a study by The Harris Poll confirms this, revealing that 79% of consumers are more comfortable seeing contextual ads than behavioral ads. For a Q4 push, where consumer sensitivity is high, this comfort level can translate directly into higher engagement and brand affinity.

Transitioning requires a multi-pronged strategy. You can’t just flip a switch. The process involves maximizing existing ID-based targeting while they last, testing new identifiers, and layering in various forms of contextual targeting. A practical approach includes:

- Implementing traditional ID-based targeting where cookies still exist to maximize current reach.

- Testing leading alternative identifiers like RampId, UID2, or ID5 to increase scale beyond cookies.

- Deploying contextual targeting based on site content, using AI for semantic analysis.

- Leveraging geo-contextual targeting for CTV, where identifiers are fragmented.

- Continuously A/B testing different targeting methods to identify the optimal Return on Ad Spend (ROAS) portfolio.

By embracing this forced evolution, media buyers can build more resilient and effective targeting strategies that respect user privacy while delivering superior performance. It’s about moving from tracking a person to understanding their context.

How to Consolidate Audience Data From Fragmented Channels Into a Single Customer View?

The root cause of cross-platform irrelevance is data fragmentation. Your audience data lives in isolated pockets within Google, Meta, LinkedIn, and your CRM, making a unified understanding of the customer impossible. A Customer Data Platform (CDP) is the strategic infrastructure designed to solve this exact problem. It ingests data from all these disparate sources, resolves identities to a single person, and creates a persistent, unified customer profile.

This “Single Customer View” is the holy grail for media buyers. It allows you to orchestrate a customer journey that is coherent and context-aware, no matter the touchpoint. Without it, you are effectively flying blind. As one report highlights, without a consistent identifier, brands can lose 10-50% of their audience during onboarding and suffer similar losses during measurement and optimization. This data leakage is a massive, hidden drain on ad spend and effectiveness.

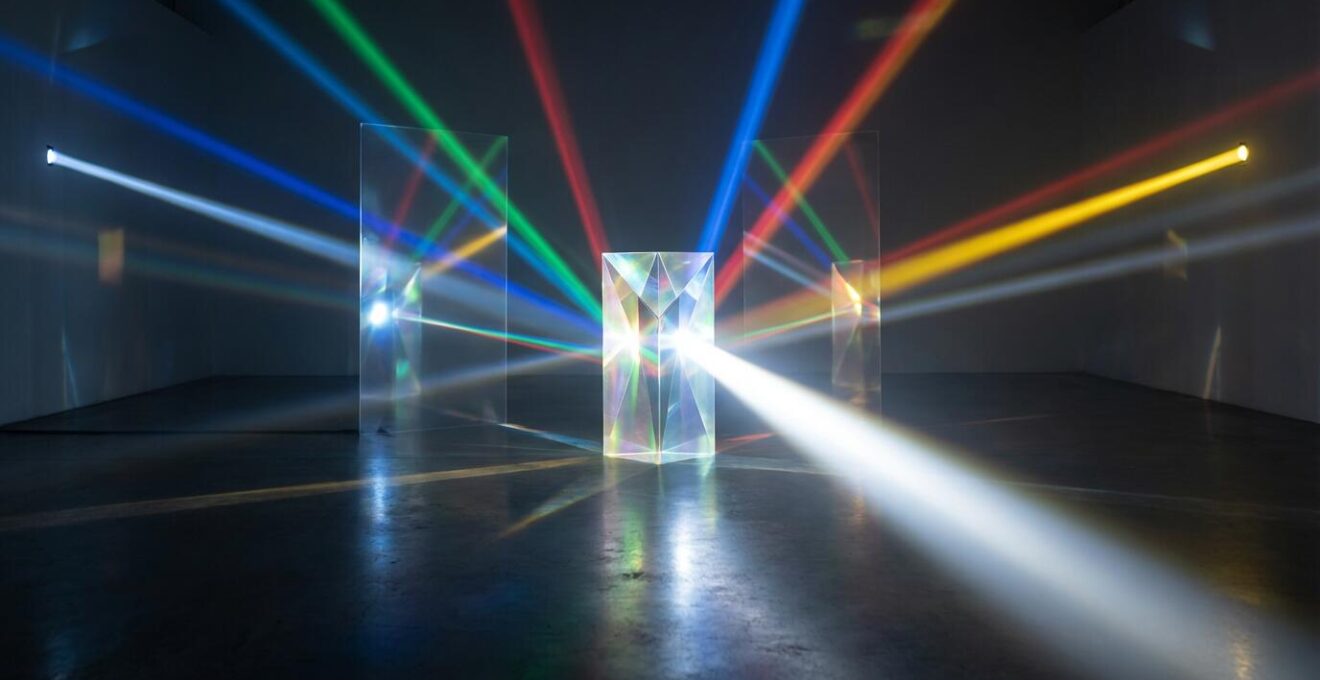

As the visualization suggests, the process involves channeling multiple streams of data—behavioral, transactional, demographic—into a central hub. This hub doesn’t just store the data; it cleanses, de-duplicates, and enriches it to create a 360-degree profile. This unified profile then becomes the “single source of truth” that you can push back out to your activation channels for highly precise targeting, personalization, and—crucially—exclusion.

A CDP is fundamentally different from a CRM or a Data Warehouse, as it is built specifically for marketer-led, real-time activation. The following table breaks down the key distinctions, highlighting why a CDP is the superior tool for achieving a single customer view.

| Feature | Customer Data Platform (CDP) | CRM System | Data Warehouse |

|---|---|---|---|

| Real-time Updates | Yes – Continuous | Limited | Batch Processing |

| Unified Customer View | Complete 360-degree | Sales-focused only | Raw data storage |

| Marketer Control | Full self-service | Requires IT support | Technical expertise needed |

| Identity Resolution | Advanced AI-driven | Basic matching | Manual processing |

| Cross-channel Integration | 100+ native connectors | Limited integrations | Custom APIs required |

Niche Industry Sites vs Big Tech: Where to Allocate Budget for B2B Precision?

For B2B media buyers, the budget allocation dilemma is acute: do you concentrate spend on the massive scale of LinkedIn and Google, or on the high-intent, targeted environment of niche industry publications? The most effective strategy isn’t an “either/or” choice but a sophisticated “both/and” approach. The key is to use these two channel types for different purposes within a single, integrated funnel.

Niche industry sites, like trade journals or specialized blogs, should not be primarily measured on direct conversions. Their immense value lies in “Signal Harvesting.” These environments attract a highly-qualified, self-segmented audience. By placing pixels on these sites, you are not just reaching potential customers; you are identifying individuals with demonstrated interest in your specific solution area. These users form the perfect seed for building powerful lookalike audiences on Big Tech platforms.

This dual-channel framework allows you to leverage the best of both worlds: the precision and trust of niche media and the unparalleled scale of platforms like LinkedIn and Google. Your budget allocation should reflect this strategic division of labor. A smaller portion (e.g., 20-30%) is dedicated to niche sites for brand authority and signal harvesting, while the larger portion (70-80%) is deployed on Big Tech platforms to activate the expanded lookalike audiences built from those high-quality signals. This creates a highly efficient system where every dollar spent on niche media amplifies the effectiveness of your larger-scale campaigns.

This method transforms your spending from a set of disconnected campaigns into a cohesive system, where one channel directly feeds and improves the other, maximizing precision and ROAS.

The Frequency Cap Error That Causes Ad Fatigue on Connected TV Platforms

Connected TV (CTV) presents a massive opportunity, but also a significant challenge: frequency management. In a fragmented ecosystem of dozens of apps (Hulu, YouTube TV, Peacock, etc.), managing ad frequency at the household level is notoriously difficult. Most Demand-Side Platforms (DSPs) cap frequency on a per-app basis. A user might see your ad 3 times on Hulu and 3 times on YouTube, hitting the platform-level cap but experiencing a total of 6 exposures. This leads directly to ad fatigue, brand erosion, and wasted impressions.

The scale of this problem is staggering. For campaigns managed without a unified frequency solution, recent data reveals that just 8-15% of households exceeded frequency caps but accounted for a shocking 42-60% of total impressions. This means a huge portion of your CTV budget is being used to repeatedly bombard a small, over-saturated segment of your audience, while other potential customers receive no exposure at all. This is the definition of inefficient spending.

Solving this requires a platform capable of cross-channel frequency management, which de-duplicates viewers across different CTV apps and the open web. This is a core function that a unified data architecture enables.

Case Study: Google’s Cross-Platform CTV Frequency Management Solution

Google’s Display & Video 360 (DV360) provides a clear example of the solution. By introducing cross-channel CTV frequency management, it unifies caps across YouTube and other major CTV apps. Instead of allowing separate caps for each platform (e.g., 5 ads on YouTube AND 5 on Hulu for a total of 10), the platform aims for a total of 5 exposures across all connected environments. It achieves this by using unified identifiers like the IAB’s Identifier for Advertising (IFA) and its own Unique Reach model to recognize a single viewer across multiple devices and apps, ensuring a controlled and optimized viewer experience.

For media buyers, the takeaway is clear: when evaluating CTV partners and platforms, the primary question must be about their capability for cross-app frequency capping. Without it, you are inevitably contributing to ad fatigue and undermining your campaign’s efficiency and impact.

How to Adapt Creative Assets for 3 Distinct User Mindsets During the Day?

Adapting creative for different platforms is standard practice. The next level of sophistication is adapting creative for different user mindsets based on the time of day and day of the week. A user scrolling LinkedIn on a Monday morning has a fundamentally different psychological state—a “Productivity Focus”—than a user on TikTok during their lunch break, who is in a “Snackable Distraction” mode. Serving the same creative to both is a waste of an impression.

This strategy, known as mindset-based dayparting, goes beyond simple scheduling. It requires mapping your audience’s typical daily energy and emotional arc and aligning your creative format and message with those states. The goal is to match your ad not just to the platform, but to the user’s immediate cognitive needs. A solution-oriented, data-driven message will resonate in the morning, while an entertainment-first, visually-driven piece will perform better in the afternoon.

Implementing this requires a matrix-based approach, where you cross-reference time periods, user mindsets, optimal platforms, and creative formats. By creating 3-5 core creative variations aligned with these mindset segments, you can use automated rules within platforms like Meta Ads or Google Ads to swap assets based on the user’s local time and context.

The following table provides a strategic framework for thinking about this alignment. It’s a starting point for developing a dynamic creative strategy that respects the user’s context and dramatically increases ad relevance.

| Time Period | User Mindset | Optimal Platform | Creative Format | Message Type |

|---|---|---|---|---|

| 6AM-9AM | Productivity Focus | LinkedIn/Email | Text-heavy, data-driven | Solution-oriented |

| 12PM-1PM | Snackable Distraction | TikTok/Instagram | 15-30 sec videos | Entertainment-first |

| 7PM-10PM | Deep Dive Research | YouTube/Pinterest | Long-form tutorials | Educational/Relaxing |

| Monday AM | Planning Mode | LinkedIn/Slack | Framework content | Strategic planning |

| Friday PM | Wind-down Mode | Instagram/Twitter | Inspirational stories | Weekend motivation |

Exclusion Logic: The Missing Step That Saves 20% of Ad Spend for Agencies

In the quest for ad relevance, media buyers obsess over who to target. An equally, if not more, important discipline is deciding who not to target. Strategic exclusion is the most overlooked lever for improving campaign efficiency and saving significant portions of ad spend. It involves proactively building and applying negative audience lists to prevent wasteful overlap between campaigns and funnels.

The most common error is running broad, top-of-funnel (TOFU) awareness campaigns that also target users already in your bottom-of-funnel (BOFU) consideration or purchase pipelines. You end up serving an introductory video to someone who has already requested a demo. This is not just inefficient; it’s a poor user experience. A sophisticated exclusion strategy creates a clear hierarchy, ensuring that users in a lower-funnel campaign are always excluded from higher-funnel messaging.

Beyond funnel stages, effective exclusion logic involves building “anti-personas.” These are segments of users you want to actively avoid, such as job seekers who only visit your “Careers” page, existing customers for an acquisition campaign, or users who bounce from your site in under three seconds. A successful implementation, as detailed in a YouTube and SEM integration strategy, relies heavily on negative audience lists to prevent overlap and ensure that prospecting campaigns only reach genuinely new users. This creates cleaner data and allows for much better measurement of down-funnel impact.

Implementing a robust exclusion process requires a systematic audit of all active campaigns to identify and eliminate costly overlaps.

Your Action Plan: Implementing Strategic Funnel De-duplication

- Points of contact: Map all active campaigns across platforms (Google, Meta, LinkedIn) to identify potential audience overlap.

- Collecte: Inventory all existing audience lists, specifically segmenting bottom-funnel users (e.g., ‘Demo Request’ lists, cart abandoners) and anti-personas (e.g., ‘Careers’ page visitors).

- Cohérence: Create a strict hierarchy by excluding bottom-funnel audiences from all top-of-funnel and mid-funnel campaigns.

- Mémorabilité/émotion: Prioritize exclusions based on cost-benefit, applying the strictest and most granular exclusions to high-cost platforms like LinkedIn first.

- Plan d’intégration: Automate the process by using a CDP or integration tools like Zapier to sync exclusion lists across all ad platforms in real-time.

Why LinkedIn Is Becoming Pay-to-Play for Company Pages in 2024?

For B2B marketers, the writing has been on the wall for years, but 2024 marks a definitive tipping point: organic reach for LinkedIn Company Pages is collapsing. The platform is now overwhelmingly a “pay-to-play” environment for brands. Relying on organic posting from a company page for lead generation or awareness is an increasingly futile exercise. The data is unequivocal. According to one report, company pages now reach only 1.6% of their followers on average, a stark decline from previous years. The feed is prioritizing personal profiles and paid content above all else.

Further analysis shows that personal posts from connections dominate the user feed, while company page posts account for a mere 5% of content (with ads making up another 30%). This means your brand’s organic post is fighting for a tiny slice of attention against an avalanche of personal updates and paid promotions. The algorithm’s preference is clear: it favors human-to-human interaction over brand-to-human broadcast.

This does not mean abandoning LinkedIn. It means shifting to a more sophisticated, hybrid strategy: the Organic-to-Paid Flywheel. This model accepts the reality of low organic reach and uses it as a testing ground to identify winning content. The strategy is simple but powerful:

- Monitor organic posts from your company page and key executives daily.

- Identify “winners”—posts that achieve an unusually high initial engagement rate.

- Amplify these proven winners by putting paid budget behind them, targeting hyper-specific, cold audiences.

- Leverage Thought Leader Ads to promote posts from executive profiles, which inherently have higher organic reach and credibility.

- Use the data from paid campaigns (e.g., which job titles engage most) to inform and refine your future organic content strategy.

This creates a virtuous cycle where organic content validates ideas at low cost, and paid spend scales proven messages with high efficiency. In the current LinkedIn climate, this flywheel is not just a good idea; it’s the only sustainable strategy for brand relevance.

Key takeaways

- True cross-platform relevance stems from a unified data architecture, not just adapted creative.

- Exclusion logic is as critical as targeting logic for maximizing ad spend efficiency and preventing ad fatigue.

- The value of data decays over time; recent, high-intent behavioral signals must be weighted more heavily than static demographic data.

How to Layer Interest and Behavioral Data for 3x Higher Ad Relevance?

Achieving a threefold increase in ad relevance isn’t about finding a single silver-bullet targeting option. It’s about the sophisticated layering of multiple data signals, each with its own weight and recency. The most effective media buyers operate like portfolio managers, combining stable, long-term data with volatile, short-term signals to create a balanced and highly predictive targeting model. With 72% of enterprise marketers considering SEM and PPC tools vital, the ability to manipulate data layers within these tools is a critical skill.

The core principle is understanding signal decay. Not all data is created equal. A user visiting your pricing page 24 hours ago is an incredibly strong, high-intent signal. A user who downloaded a whitepaper 30 days ago is a moderate signal. An interest in “B2B software” declared six months ago is a weak, background signal. Your targeting model must reflect this reality by assigning a higher weight to more recent and more explicit behavioral data.

A static approach that treats all these signals equally will inevitably lead to irrelevant messaging. You might retarget someone with a product ad long after they’ve lost interest, or fail to act on a user who is in a critical decision-making moment. The solution is to build a dynamic weighting model that prioritizes signals based on their predictive power for conversion.

The following model provides a framework for how to think about weighting different data layers. The “Relevance Score” is a conceptual guide to prioritizing which signals should trigger your most aggressive and highest-value messaging.

| Data Type | Recency | Relevance Score | Weight in Targeting |

|---|---|---|---|

| Pricing page visit | Last 24 hours | 10/10 | Primary signal |

| Cart abandonment | Last 7 days | 8/10 | High priority |

| Content download | Last 30 days | 6/10 | Supporting signal |

| Industry interest | 6+ months old | 3/10 | Background context |

| Demographic data | Static | 2/10 | Baseline filter only |

Ultimately, maintaining ad relevance across a fragmented ecosystem is an architectural challenge. It requires a strategic shift away from platform-specific tactics and toward building a centralized, audience-first data infrastructure. By consolidating data into a single customer view, implementing sophisticated exclusion logic, and layering data signals based on their recency and intent, you can move beyond simply managing campaigns to orchestrating a truly coherent and effective customer journey. Begin today by auditing your data flows and identifying the first step toward a unified strategy.